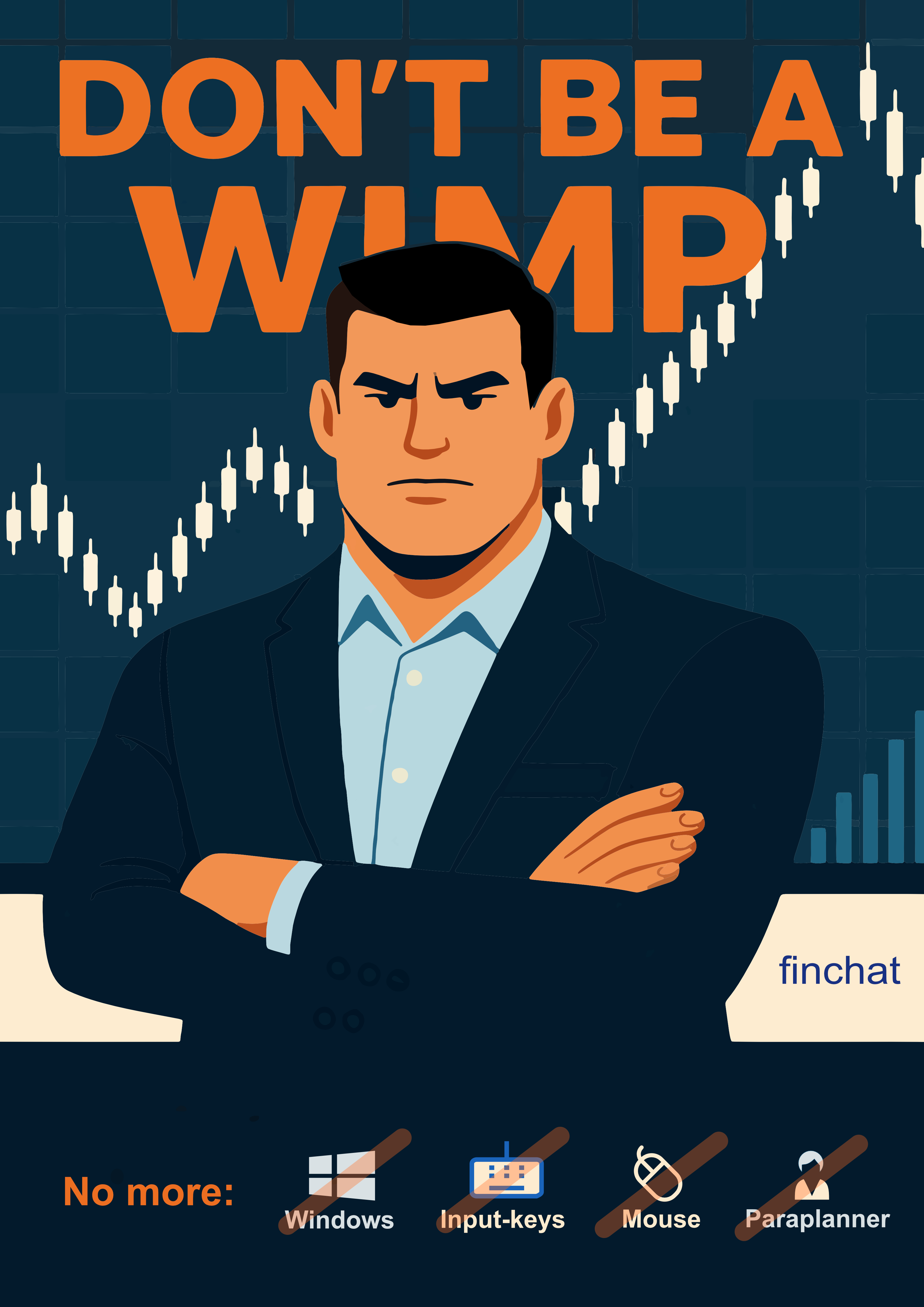

Don’t be a wimp!

Windows, mouse, and keyboard are going the way of the dodo. It’s much easier to talk in your normal voice.

In the context of financial planning advice:

Windows OS: Will slowly become invisible. It will live mostly in the cloud, streaming apps with minimal local hardware. This has begun with the ChromeOS model, Windows 365 Cloud PC, and “thin clients” with voice interfaces (lightweight, low-power computers that rely on a central server for most of their processing power, storage, and applications). Linux currently dominates servers, clouds, supercomputers, and embedded devices. If desktops move that way, Windows could vanish.

Input keys: Future interactions will incorporate touch, voice commands, and spatial computing (gestures in 3D space). Who needs a keyboard?

Mouse: Mouse and pointer will disappear along with menus. The user will simply issue a voice instruction, make a gesture (like pinch-to-zoom and multi-finger scrolling), or tap a screen.

Paraplanner: Paraplanners are currently essential to financial planning. An adviser sends a client’s details to the paraplanner (who seldom meets the client), and they construct an SoA (Statement of Advice) from those details. Once completed, they send it back to the adviser, who presents it to the client. It is a long, expensive process that prohibits testing scenarios with the client where calculations are done separately by the paraplanner.

As of June 2025, there were 15,544 financial advisers, a significant drop from over 28,000 in early 2019. The number is expected to decrease further to around 14,000 by early 2026. The industry needs a new direction.

Things are changing, and new models are being developed.

Finchat, for example, already uses voice and simple buttons to give instructions, making it much more user-friendly. It uses the “thin client” model, where a central server provides storage and applications. An adviser can plug a $50 Fire TV Stick into a client’s TV, and it is automatically linked to the software and responds to natural voice. They can sit on their couch and ask, “Can I retire at age 60?” or examine products.

Models like this are the future and could super-charge the advice industry.