AI – Is it ACCURATE? Does it reduce HEADCOUNT?

We continue to monitor AI where it matters most. Is it ACCURATE, and can it reduce HEADCOUNT?

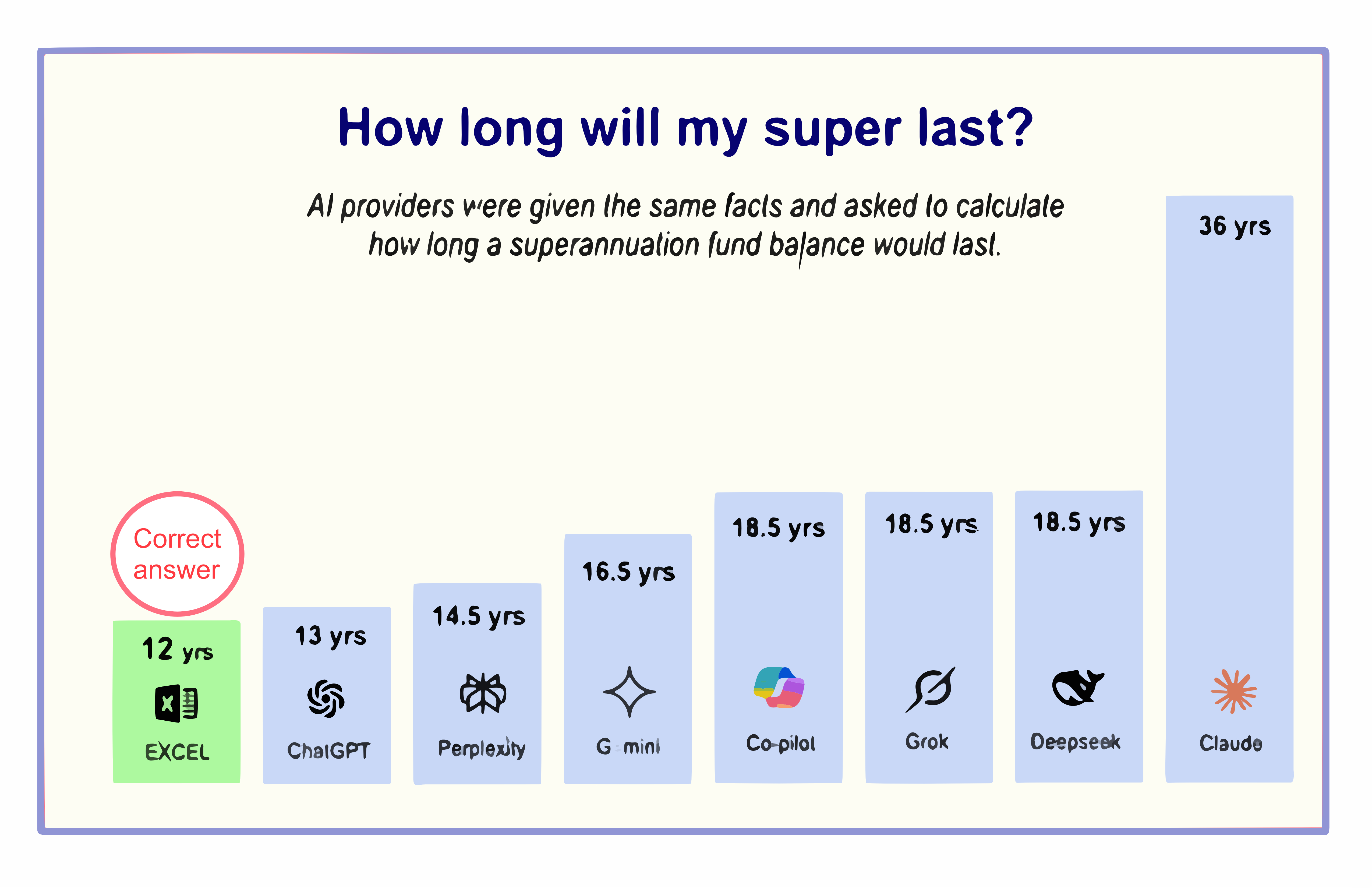

ACCURACY

As you can see from the image above, accuracy is still an issue. A recent test that demanded reasoning, knowledge, and tax rates tripped them all up, although ChatGPT was one tiny misstep away from a perfect result. The fact that they all confidently came to a different (and incorrect) answer is cause for reflection.

HEADCOUNT

1. CODING

Claude does all our coding, and on the whole, at a very high level. The cost of a human with equal expertise would cost around $1,000 a day per person; we pay $1 with no sickies, resignations, holidays, etc.

2. OFFICE ASSISTANT

We also asked Claude to construct a voice-based CRM, connecting two databases and offering a UX with buttons, navigation text, and charts. So far, it’s going very well. We just tell Claude what feature we want in natural language, and in seconds, the code is there. We test it and send any error messages to Claude, who instantly fixes them. When finished, it will be like a “super assistant”. You give verbal instructions such as “update data”, “produce a report”, “start a campaign”, etc., and it’s done instantly. The need for an office assistant has reduced.

3. PARAPLANNER

Our financial planning app (https://www.finchat.com.au) dispenses with the need for a paraplanner. The adviser can simply “chat with the app,” even during a client meeting.

We see enormous productivity gains with AI and suspect most businesses will find the same. This new revolution will see jobs disappear and new ones appear. One thing is certain: every business will have its “AI GUY”.